Considering funding for your business? Not all money, or debt is the same. Understanding this is critical to small and large businesses alike, particularly in times of growth or renewal.

Don’t know your good debt from your bad … read on.

Why use debt in your business?

Debt enables a business to take large steps forward and most successful companies carry and use some debt. The key reason is leverage. Leverage is the idea of extracting value from one asset to grow or enable the purchase of another asset. Two productive assets are better than one (both in terms of revenue and reduced risk) and debt simply magnifies the gains by expanding your productive asset base in a tax efficient way.

Financing assets such as property, vehicles, and equipment remain common but also important today is the development of soft assets such as people, systems, and marketing approaches. A good understanding of how to harness debt is essential in today’s business environment and you’ll develop management skills along the way, particularly in business development, financial and project management.

What is “good” debt and how can it be used?

“Good” debt is associated with any wealth creation activity. Consider how your business generates income and what occurs when capacity is increased, good debt enables this.

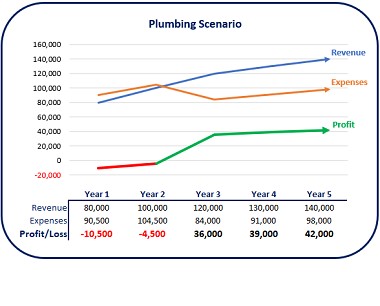

To demonstrate the idea, let’s consider a Plumber who earns revenue from maintenance contracts using service teams comprising a plumber, vehicle, and tools. The business can grow if it establishes new teams to take on larger maintenance contracts. Capacity and earnings are increased by using debt to purchase the new vehicles and tools. When expanding your business like this, think through the financial outcomes such as net asset gain, net income gain, or net productivity gain. A ‘net gain’ means the component over and above costs.

In this scenario, the Plumber purchases a new vehicle and tools for $60,000 which is funded over 2 years at 7.50% p.a. with loan repayments of $34,500 in Year 1 and again in Year 2.

The new team takes time to get up to speed with invoices totalling $140,000 in Year 3 onwards with a 30% profit margin applied to revenue.

Whilst the results are impacted by loan repayments in the early years, the new team makes a strong contribution from Year 2 onwards.

The use of funding in this way can be repeated to build a larger, stronger and more profitable business. Short-term initiatives like this are best supported by an Unsecured Business Loan because of the time needed to implement and generate income sufficient to cover additional business expenses (inclusive of loan repayments). In this example, the expansion project contributed from Year 2 onwards after the loan was repaid. Today, the market is very competitive with range of Lenders seeking to support initiatives at a competitive interest rate. Learn more here.

What is “bad” debt and why should it be avoided?

“Bad” debt, in this instance, is the type used to support overheads and operating expenses. So while it’s good practice to fund the purchase of vehicles, machinery, and equipment used in producing income (ie. productive assets), it’s unsustainable to use debt to pay ongoing running costs such as the telephone bill, rent, or wages. Using debt is these ways should be avoided, or at least managed carefully to avoided a situation where funding sources are exhausted before new income streams come on-line.

For an established business it’s considered acceptable to bridge a cash-flow gap or support working capital with debt funding. Working Capital is the cash tied up in Accounts Receivable (an Asset) which represents work completed but not yet paid for by the customer.

For a growing business the cash needed to cover working capital continues to grow and it needs to be funded, one way or another. Invoice Finance is the logical choice for supporting working capital. It’s a flexible funding solution for growing businesses that issue invoices to customers on credit terms (eg. Invoice payable within 30 or 60 days). When established, the loan facility moves in alignment with the activity of the business at the time. Learn more here.

What other benefits exist?

Debt has its benefits and most businesses can access funding on acceptable terms from the Alternative Finance market.

Using debt is tax effective because interest payments are a deductible business expense. Raising business expenses in this way reduces your taxable income which has the effect of re-investing in your business instead of paying away cash in taxes.

Taking Debt can even help build a good business credit record which can assist when making future requests for finance. A business with an established credit history always looks better than a business with no history at all.

Conclusion

Good debt really does exist and when viewed positively it enables business expansion. Debt alone is not the answer but debt used smartly can move your business forward. It can be one of the best ways of unlocking your business and accelerating growth.

As a business operator, remain receptive to new ideas and continue to enhance the capacity of your business to implement new initiatives. Successful implementations build confidence and momentum in the business which leads to improved business performance over time.

Looking to fund your next project, contact Influx Funding for a no obligation loan recommendation.

References:

1. Investopedia, “Leverage” defined.

2. Scott Allen, 20/3/2017, The Balance, “Debt Financing: Pros and Cons“.

3. Small Business Blog, Bond Street, “6 Advantage of Debt Financing“.

This article has been provided by Matt Farrell of Influx Funding.

National Fleet Young Buyers

We have a new service just for young buyers:

- Free vehicle buying advisory assistance

- Salary Packaging for the first buy

- First-time consumer advice

- Young buyer VIP test drives

1300 NF SAVE

130063 7283

Female First for young Women

Especially for young women buying their first car, we have young female consultants who will understand your needs.

Female First Finance - Youth

Find out more!